how to claim california renter's credit

To claim the CA renters credit. Or on the screen Take a look at.

California Security Deposits Everything You Need To Know Welease

How you get it.

. 1 Best answer TerryA Level 7 June 4 2019 338 PM You can just run through TTCalif again to access the Renters Credit screens. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident.

I was able to claim the Renters Credit on my 2017 return. Select CA Other Credits. I lived and payed rent in an apartment for all of 2017 and part of 2018.

Lacerte will determine the amount of. Availability The credit was. These states have worked out their own formulas for awarding a renters tax credit to eligible tenants.

The Renters Tax Credit can be claimed by individuals through the California Franchise Tax Board. The FTB is the state agency that handles the state income tax. You qualify for the Nonrefundable Renters Credit if you meet all of the following criteria.

Part way through 2018 I moved into a room in a. To claim this credit you must. To claim the renters credit for California all of the following criteria must be met.

From the left of the screen select State Local and choose Other Credits. File a Married Filing Separate or RDP Return Did not live with your SpouseRDP during the last six months of the year Furnish over half of the household. Check the box Qualified renter.

You were a resident of California for at least 6 full months during 2021. California Resident Income Tax Return Form 540 2EZ line 19. Claims for this credit.

To claim the renters credit for California all of the following criteria must be met. To claim the CA renters credit Go to Screen 53 Other Credits and select California Other Credits. You May Be Able to Claim a Renters Tax Credit If You Live in These States Claiming a renters credit on your taxes can help put money back in your pocket Eligibility.

Fill out Nonrefundable Renters Credit Qualification Record available in the California income tax return booklet for your own tax records dont send the form to the FTB. Nonresidents cannot claim this credit. In California renters who pay rent for at least half the.

Go to the Input Return tab.

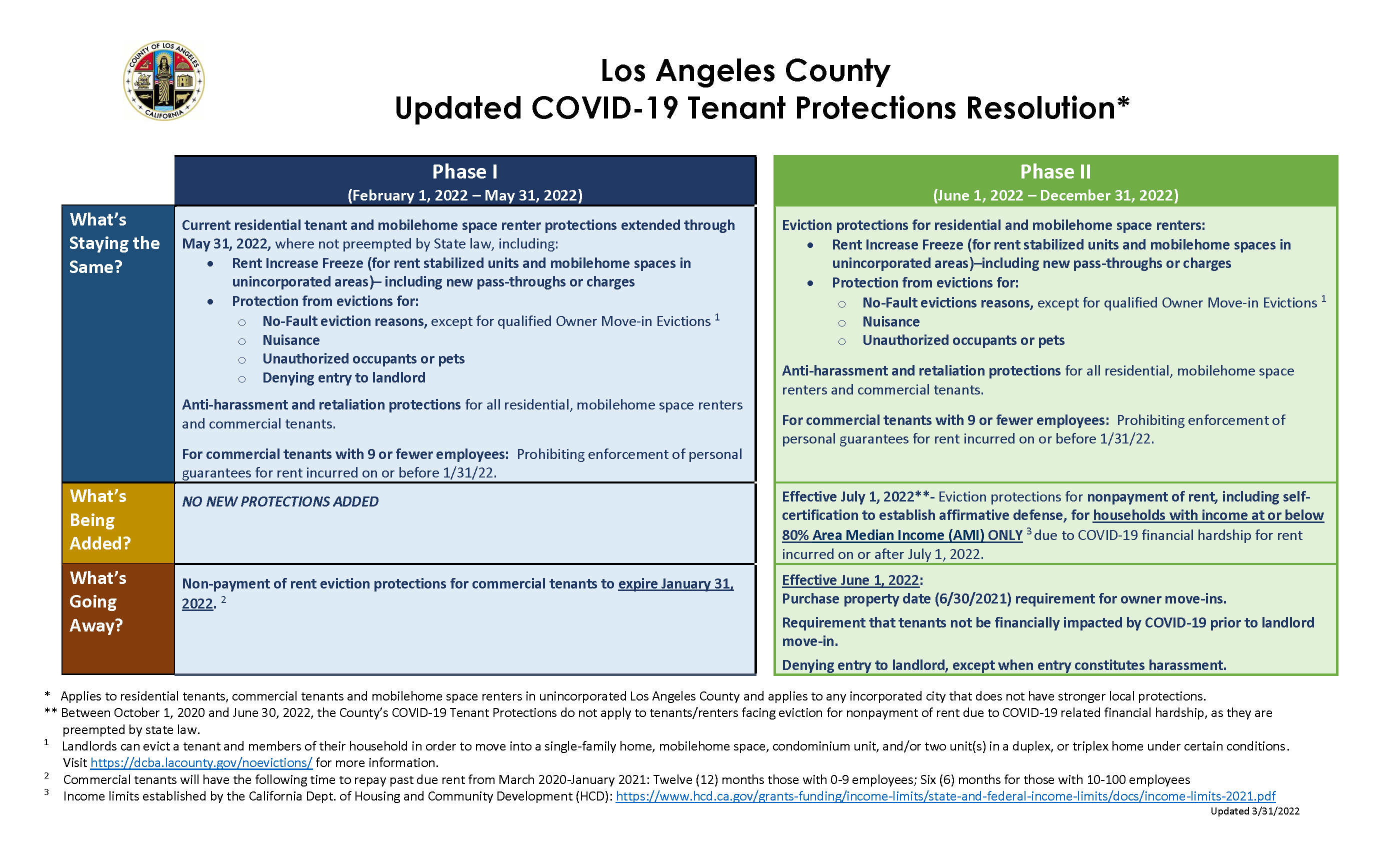

About L A County S Covid 19 Tenant Protections Resolution Consumer Business

California Politics The Taxes Paid By 100 000 Millionaires Los Angeles Times

Renters Tax Credits And Rebates 2022 Propertyclub

Mw My 2004 Federal And State Tax Returns

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Fraudulent Rent Relief Claims Divert Funds Delay Responses To Renters And Those In Need Abc7 San Francisco

Emergency Renters Assistance Program

Emergency Renters Assistance Program

Cap Riverside Volunteer Income Tax Assistance Program Vita Ppt Download

Legal Requirements For Denying A Rental Applicant Adverse Action Letter

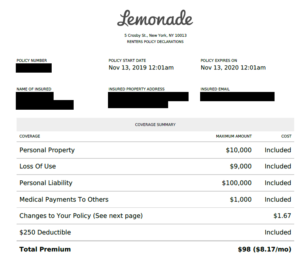

Renters Insurance Claim Tips California United Policyholders

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

Renters 7 Tax Deductions Credits You May Qualify For The Official Blog Of Taxslayer

The Best Cheap Renters Insurance In California For 2022 Nerdwallet

Caleitc And Young Child Tax Credit Official Website Assemblymember Wendy Carrillo Representing The 51st California Assembly District

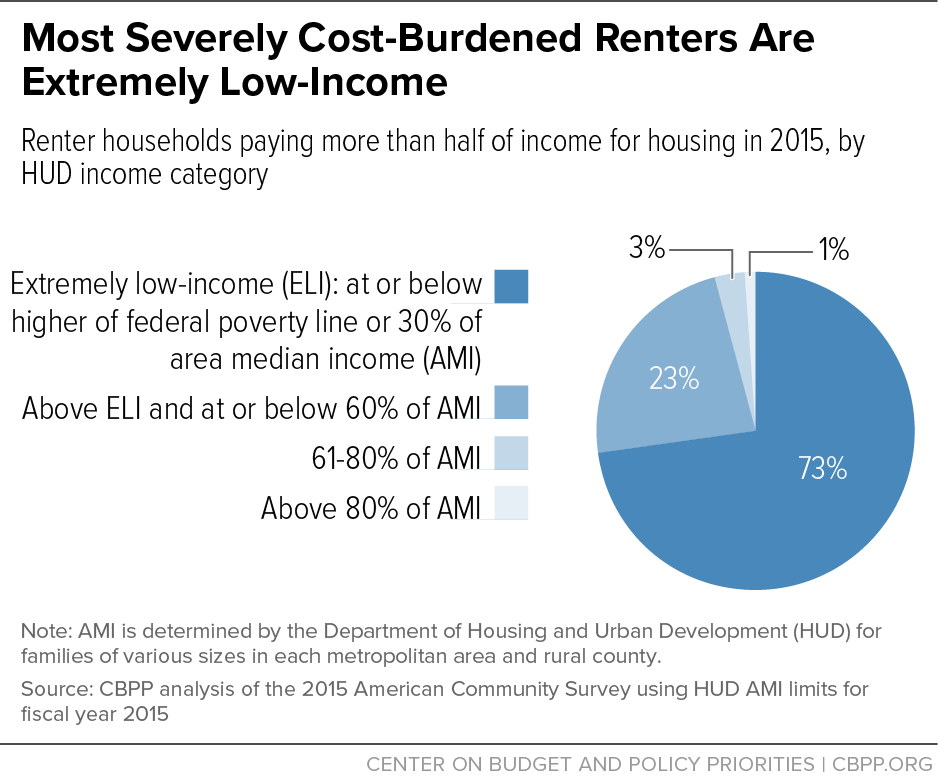

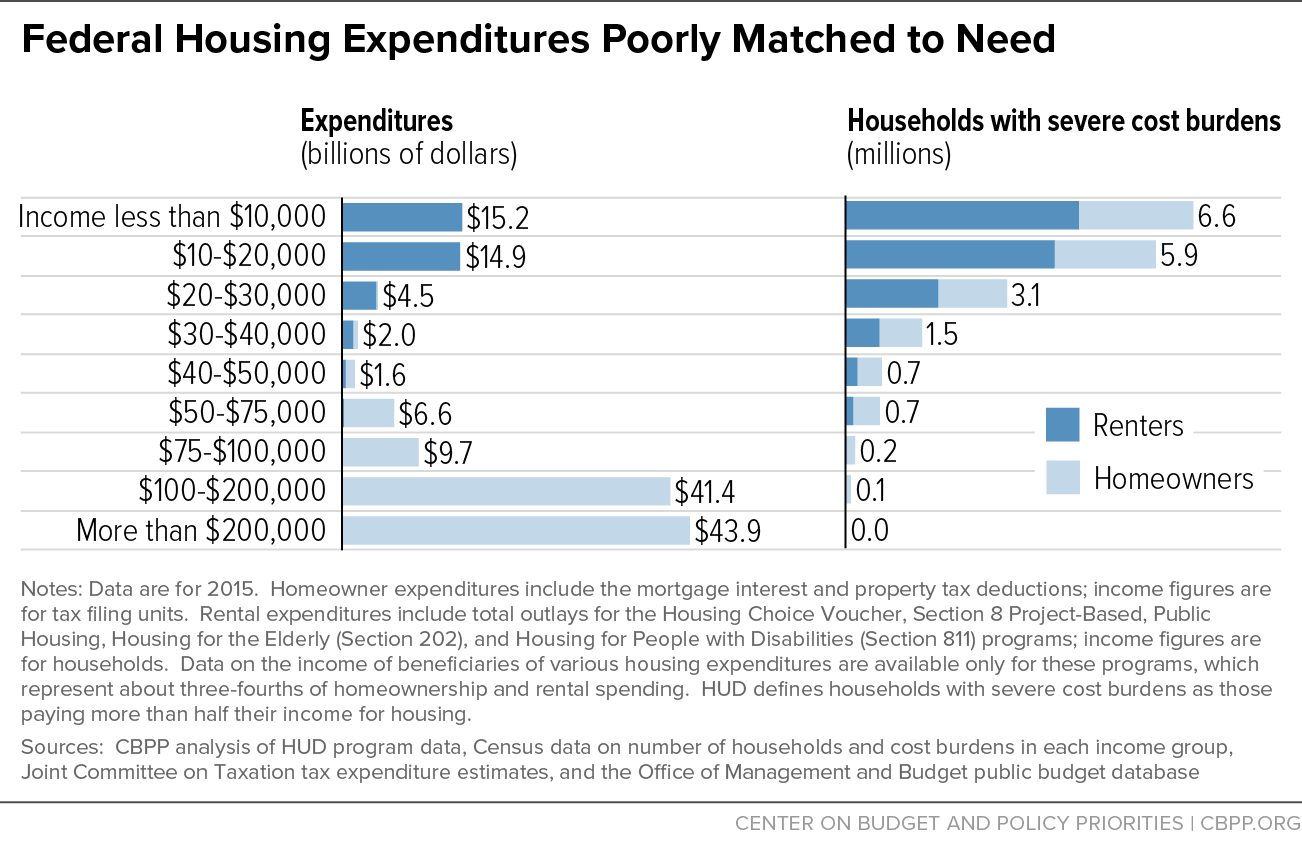

Renters Credit Would Help Low Wage Workers Seniors And People With Disabilities Afford Housing Center On Budget And Policy Priorities

Renters Credit Would Help Low Wage Workers Seniors And People With Disabilities Afford Housing Center On Budget And Policy Priorities